Overseas Tax Ireland

A new parallel Tax system that works along side the existing system has been added for Irish customers. The “new system” will calculate Overseas Tax on Gross revenue for the landlord.

FOR IRELAND

Overseas Landlords can now choose to:

Use the current tax calculation method ( Balance Minus Expenses )

Use the new tax calculation method ( Based on Gross Revenue ) e.g. if Rent of £1000 is received, then £200 (20%) tax is due irrespective of other expenses

Use a 3rd party (other than you the agent) to deal with their tax i.e. you pay them as normal like a resident landlord even if they have an overseas address.

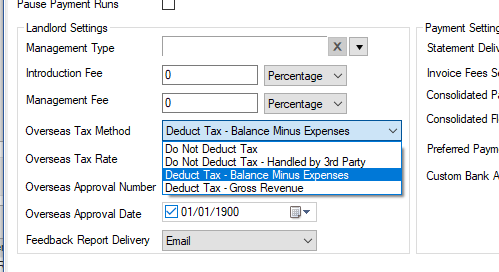

Setting the Overseas Tax Method

This is set via a field per Landlord to switch the mode of calculation.

When creating a new landlord record, the default value of this field will be "Do Not Deduct Tax".

However, when attempting to save an overseas Contact, a prompt will be displayed if the Overseas tax method is set to Do Not Deduct Tax.

Select the applicable Tax Method from the options:

Do not Deduct Tax - resident landlord, no tax deducted

Do Not Deduct Tax – Handled by 3rd Party - these Landlords will be treated as resident landlords even if they have an overseas address. **NEW**

Deduct Tax - Balance Minus Expenses - ** CURRENT METHOD**

Deduct Tax – Gross Revenue - ** NEW METHOD**

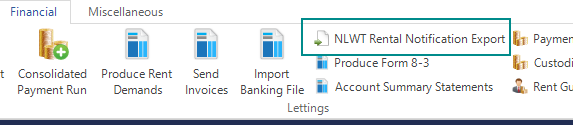

NLWT Rental Notification Export

A NLWT Rental Notification Export option is available from the Financial tab.

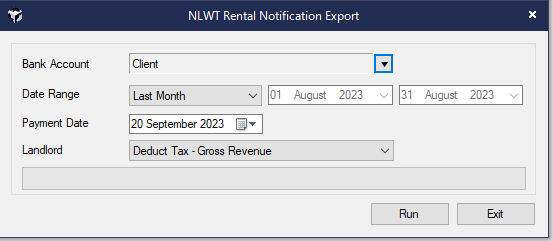

This is will display the following screen:

The export will only include transactions included on a Statement. Start and end dates can be entered to select the required date range.