Charge Interest on Arrears

This screen provides the ability to calculate and charge interest on unpaid Transactions. The Charge Interest on Arrears is accessed by Financial Tab -> Debt Management -> Charge Interest On Arrears.

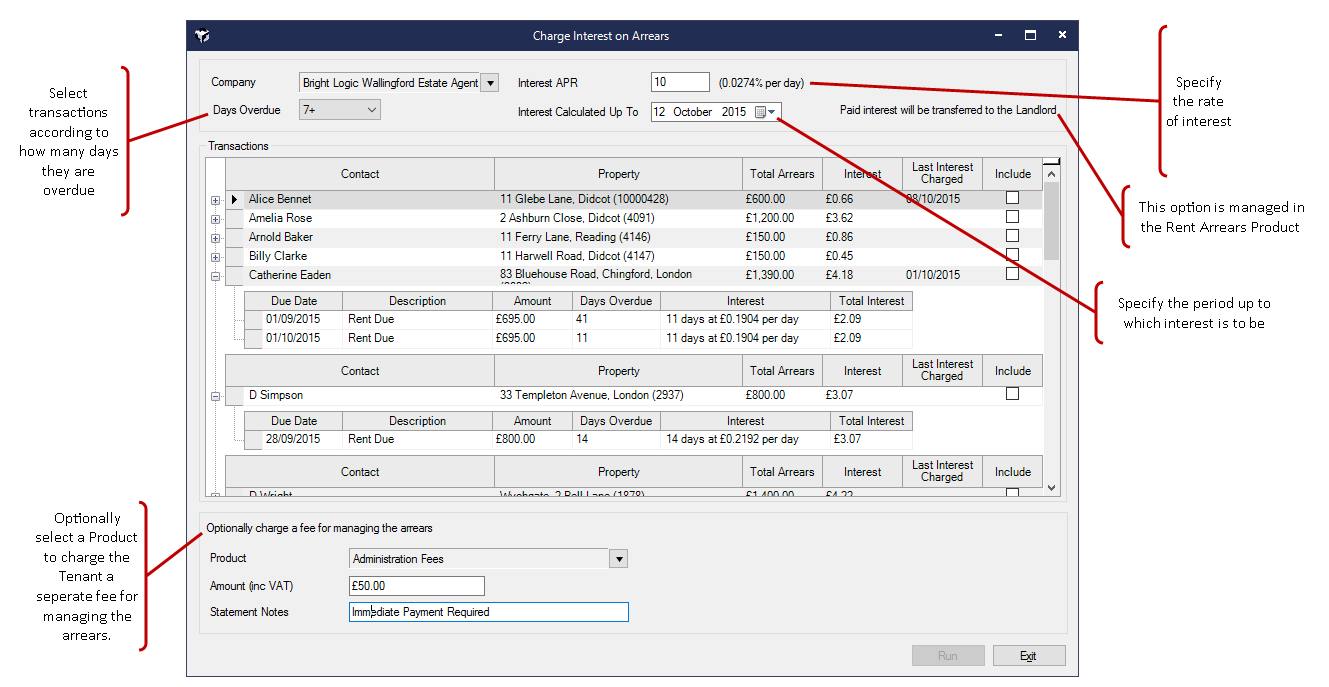

How to use the Interest on Arrears screen

Paid interest will be passed to the Landlord.

Select the Company.

Specify the Interest APR at which interest is to be calculated.

At Days Overdue select the days overdue from the drop down list.

The Interest Calculated Up To field allows you to specify the period up to which you want interest to be charged.

The following will be listed for each Transaction

Property

Total Arrears

Interest

Last Interest Charged

Under the Include column tick the Contacts you want to charge interest against.

Optionally, a separate fee can be charged to the Tenant for managing the arrears.

Select a Product

Specify an Amount

Enter Statement Notes if required

Example:

The calculation for interest is: ((Amount Due / 100) * (Interest Percentage/365)) * No. Days

E.g. If a rent due is £1000 and is overdue by 20 days and the interest is 10% the calculation would be:

((1000 / 100) * (10/365)) * 20

(10 * 0.027397) * 20 = £5.48

The No. Days is either the difference in days between either the last interest charge date for the Contact/ Property or the due date of the original rent due (whichever is more recent) and the interest calculated up to date.

A new product of Rent Arrears Interest is used for raising the interest transactions, this will default to transfer the interest to the Landlord once it's paid. When loading the Charge Interest screen if the Rent Arrears Interest Product is set to Transfer to Landlord when paid, a label will be displayed to inform the user.