Bank Account Balance Report

The Bank Account Balance report details the funds held for each Contact and what's in the Client Account, for any given date in accordance with ARLA / NSPRA guidelines.

Refer to: ARLA legislation

NPSRA legislation

Running the Report

Generate the report from Bank Account Balance Report on the Managements Reports screen and click Run. Alternatively it can be run from via the Financial tab -> Bank Account Balance.

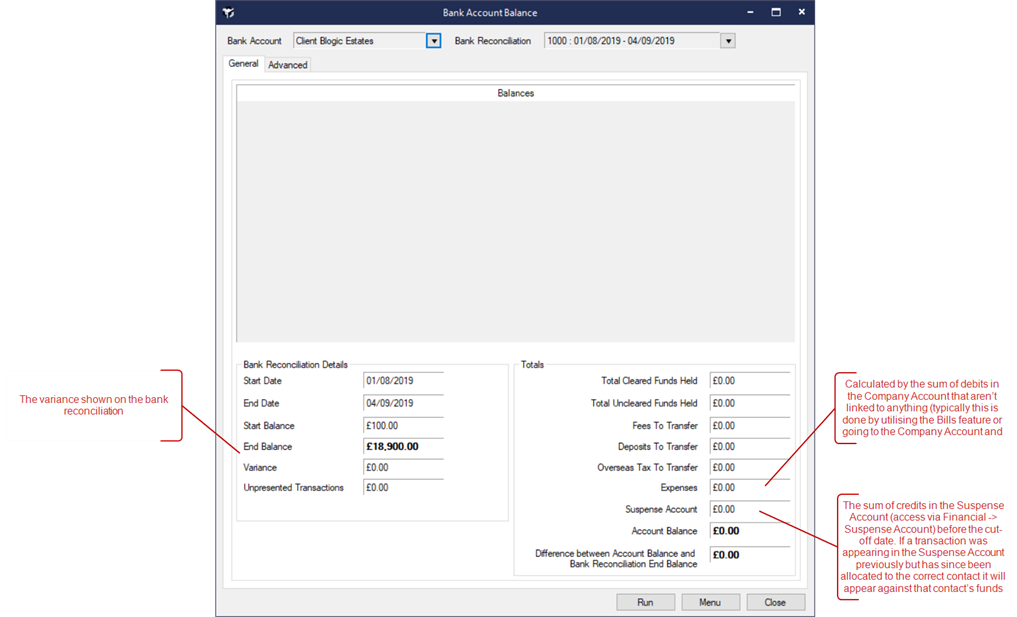

When a Bank Account is selected, the Bank Reconciliation field will be set to the most recent Bank Reconciliation. Dates can only be selected based on your Bank Reconciliation end dates.

When a Bank Reconciliation is selected, the details are automatically loaded in the bottom left of the screen. Provided you have permissions to create / edit bank reconciliations, a View button will also be displayed.

The variance figure on the General tab shows the difference between the Company Account in Acquaint and the end balance of the Bank Reconciliation.

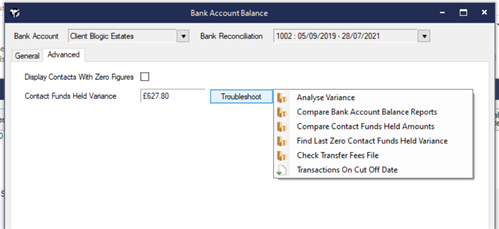

The variance figure can be found on the Advanced tab. The menu options to troubleshoot the variance can be accessed via the Troubleshoot button.

The screen can run for any given cut-off date for a specified Bank Account. The Bank Account Balance screen inspects each transaction in the Company Account from the Opening Balance Date for the Client Bank Account (or the very first transaction in the account if no Opening Balance has been entered).

The Balances are totalled by Contact Type.

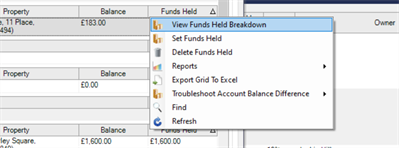

To view a breakdown of funds held for a Contact. Right click on a Contact and select View Funds Held Breakdown. This option can also be accessed from a Contact's Account screen.

Before generating the opening Balance for the client bank account ensure all the financial processes have been run in Acquaint (e.g. pay contacts, transfer fees, transfer deposits, transfer overseas tax, bank reconciliation) otherwise this may cause discrepancies. Avoid running a bank reconciliation for today as it's linked to the bank reconciliation it's unlikely to balance until the transactions have been finalised.

Bank Account Balance Report looks at all transactions that appear in Contact’s account with a Banking Date between the Opening Balance date of the Bank Account and the selected cut-off date (transactions with a banking date of 01/01/1900 will be ignored). This should reflect the funds held for each Contact.

The Bank Account Balance runs off data in the Company Account and is calculated by money received from the Contact plus money transferred from other Contacts, less Payments, plus fees that requiring transferring, plus paid Maintenance, plus Overseas Tax that requires transferring, plus Deposits that require transferring, plus transfers to other Contacts.

The report is grouped by Contact Type.

Totals are displayed for:

Total Cleared Funds Held

Total Uncleared Funds Held

Fees to Transfer

Deposits To Transfer

Overseas Tax To Transfer

Expenses - calculated by the sum of debits in the company account that aren’t linked to anything (typically this is done by utilising the Bills feature or going to the Company Account and clicking the New Charge button) before the cut-off date.

Suspense Account - the sum of credits in the Suspense Account (access via Financial > Suspense Account) before the cut-off date. If a transaction was appearing in the Suspense Account previously but has since been allocated to the correct contact it will appear against that contact’s funds held total instead of being included in the Suspense Account total.

Account Balance

Difference between Account Balance and Bank Reconciliation End Balance

The following options are available from the Menu button

Reports

Export Grid to Excel

Troubleshoot Account Balance Difference

Find

Refresh

The Advanced tab has options for whether to display Zero Figures or whether to refresh the data after the funds have been manually changed.

Troubleshooting the Variance figure on the Bank Account Balance Report

If a variance occurs, trouble shooting tools are available under the Advanced tab to investigate discrepancies. Follow the steps below to troubleshoot the variance figure:

Analyse Variance

Run the Analyse Variance screen from Menu -> Troubleshoot Variance -> Analyse Variance.

This screen will identify any transactions that potentially cause a variance figure on the Bank Account Balance Report. The transactions displayed are not guaranteed to make up the variance figure, however may be worth investigating. The screen defaults to Only Include Transaction on Cut Off Date clear this box if you want all transactions up to the Cut Off Date.

Compare Bank Account Balance Reports

Compare two Bank Account Balance Dates.

Compare Contact Funds Held Amounts

This screen will run the Bank Account Balance Report for the selected dates and list Contacts whose Funds Held has changed.

Find Last Zero Contact Funds Held Variance

As the variance figure may be an accumulation of variances over different days you will need to find the date that the variance first occurred.

This can be done easily from Menu -> Troubleshoot Variance -> Find Last Zero Contact Funds Held Variance on the Bank Account Balance screen.

This will run the Bank Account Balance report each day, starting from the cut-off date and working backwards, until a zero variance figure is found. Please note that this may take a long time depending on how much financial data there is in Acquaint.

Once a zero variance figure has been found run the Bank Account Balance report for the next day (e.g. if the last zero variance figure was on 01/01/2018 you will need to run the report for the 02/01/2018).

Check Transfer Fees File

This screen will read the selected Transfer Fees file and check Acquaint for any data issues (e.g. missing transactions, transaction amounts that have changed, etc).

Transactions on Cut-Off Date

The variance may be caused by one transaction that’s being included in the Bank Account Balance report. This will open a CSV file in Excel. Search the debit and credit columns for the variance figure.

When a Rent Due is paid it will show as funds held against the Landlord, regardless of whether the Rent is currently due or due in the future (same applies to transactions which use a Product that is set to Transfer to Landlord when paid).

Paid maintenance charges appear as funds held against the Contractor.

Fees, Overseas tax and Deposits that require transferring will show as separate totals at the bottom of the screen.

Discrepancies can occur if the Opening Balance was generated before all the financial processes were run in Acquaint (e.g. pay contacts, transfer fees, transfer deposits, transfer overseas tax). Any discrepancies will appear in the Variance field.

Only one copy of the screen can be open on the PC at any time.