Accounting Software Integration

Inputting Profit Figures into Accounting Software

Initial Configuration

Before entering any data for the first time, create a dummy Acquaint record as a contact in your accounting software. This setup step only needs to be done once. Once the record is created, you're ready to begin entering figures. From that point onward, all transactions will be recorded against this single Acquaint contact.

Example:

In Acquaint Software

Click the Main tab → Management Reports → Product Sales Report option

Select the desired date range and select VAT Accounting mode of Standard or Cash.

Click the Run button and ensure the Product Sales Report is in Summary mode

In your Accounting software

Create a new Sales Invoice against the dummy Acquaint record (as described in the initial configuration above)

All subsequent sales invoices should be raised against this same dummy Acquaint record.

Set the Due Date of the Sales Invoice to the end date used for the Product Sales Report

Add each product on the Product Sales Report as a new item to the Sales Invoice

Save the Sales Invoice

If you have any unassigned or unallocated payments from Transferring Fees (see below) use these to pay off the Sales Invoice

Note: We recommend that you do this on a monthly basis in arrears (e.g. In September input profit figures for August)

Transferring Fees in Accounting Software

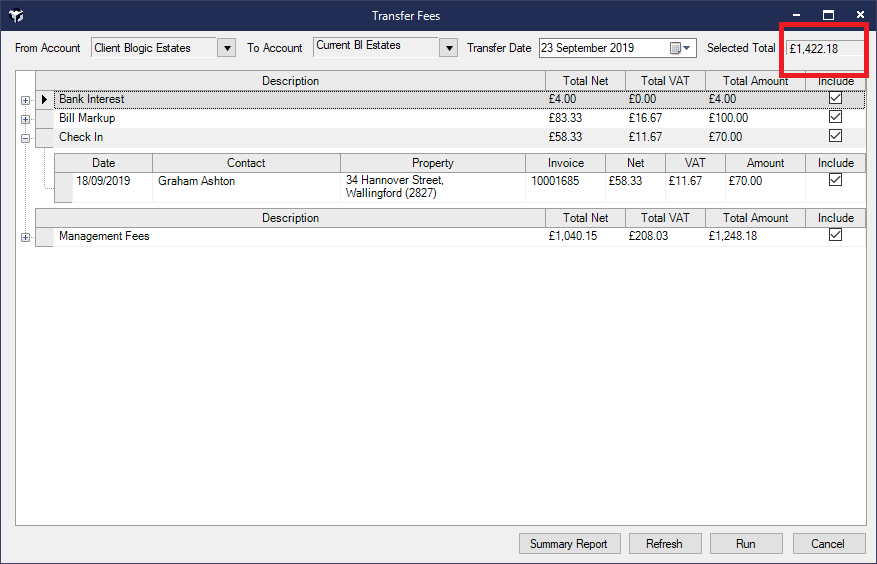

1. Go to the Transfer Fees screen in Acquaint via the Financial tab → Account Transfers → Transfer Fees

2. Tick on all the fees you wish to transfer

3. Make a note of the Selected Total in the top right hand corner

4. In your accounting software receive a payment of the total amount of fees transferred against the dummy Acquaint record (as described in the Initial Configuration above).

5. Assign the payment to any outstanding Sales Invoices against that dummy Acquaint record record starting with the oldest first.

Note: This can be done as often as desired