Overseas Landlords and Withholding Tax (Ireland)

OVERSEAS LANDLORDS AND WITHHOLDING TAX ON ACQUAINT

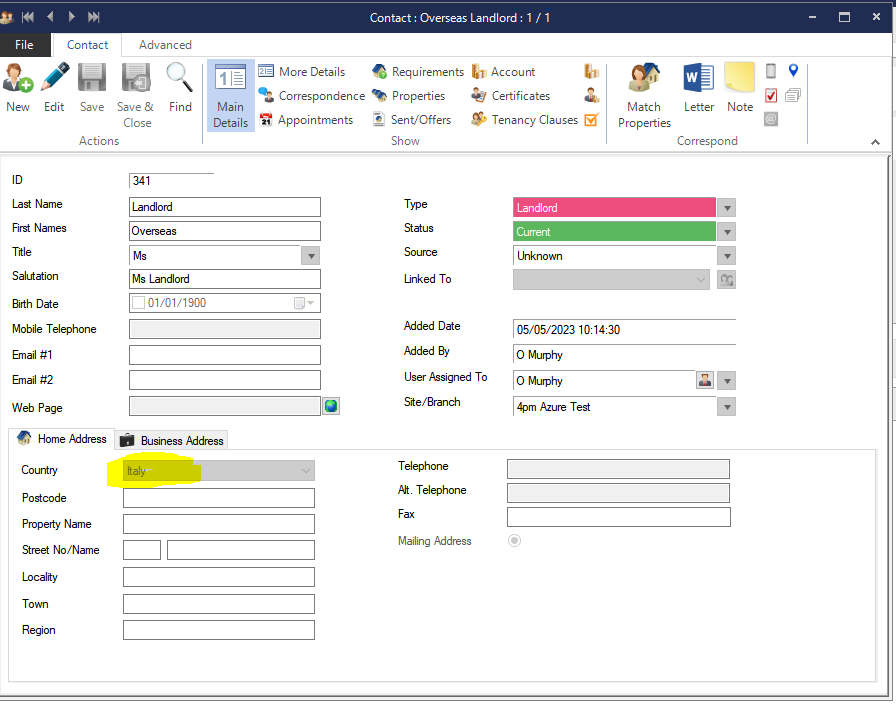

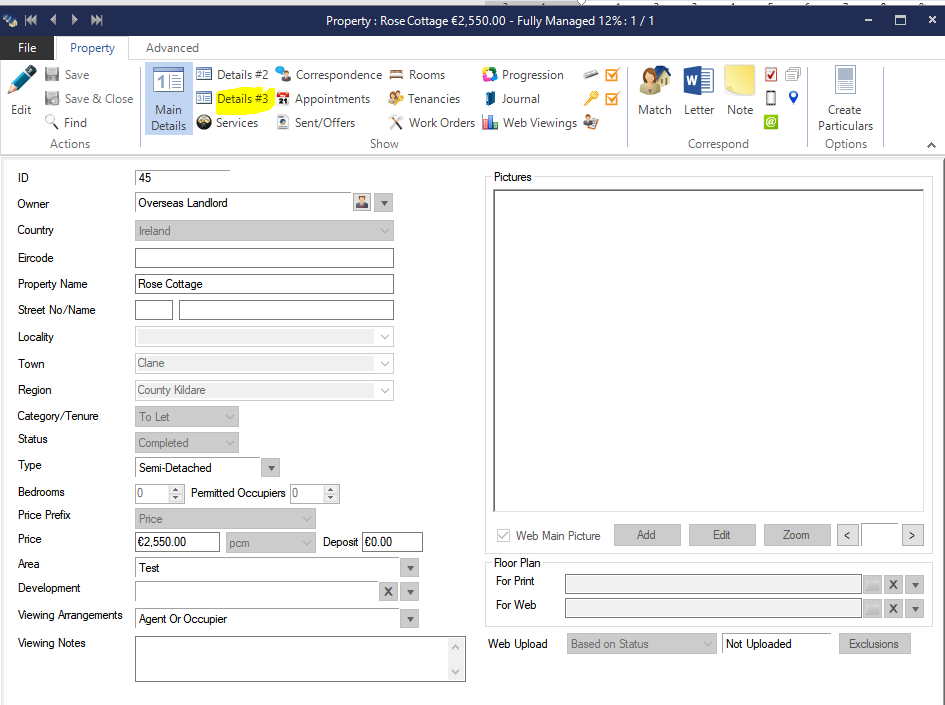

Setting up an overseas landlord.

Country – any country other than Ireland

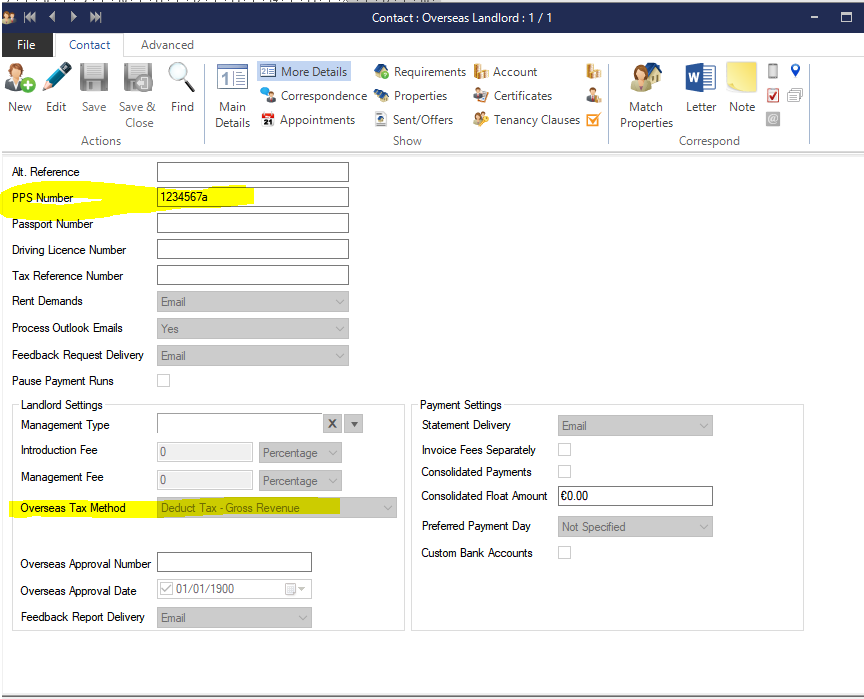

Click on “More details”

Insert PPS number

“Overseas tax method” – should be “Deduct Tax – Gross Revenue”

See Appendix A for further explanation

Once this is set up, Acquaint will start withholding 20% tax of the gross rent received, as required by Revenue

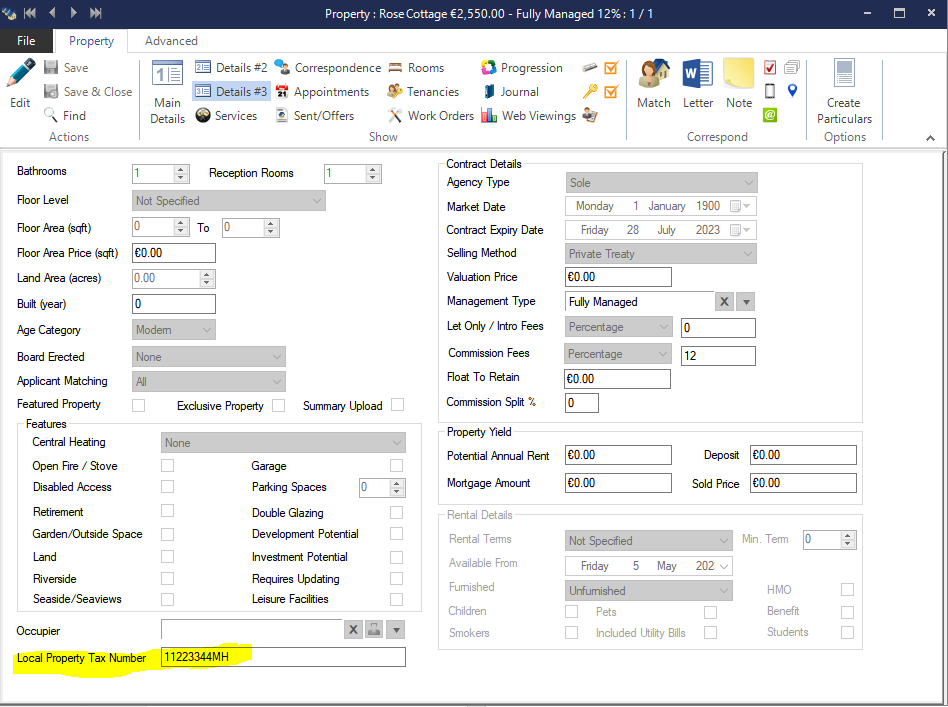

Inserting LPT number

Click into “Details 3” on the property, and insert the LPT number into “local property tax number” at the bottom of the screen.

Process for collecting overseas tax

Once your overseas landlord is set up, then Acquaint will start withholding overseas tax when you pay your landlords.

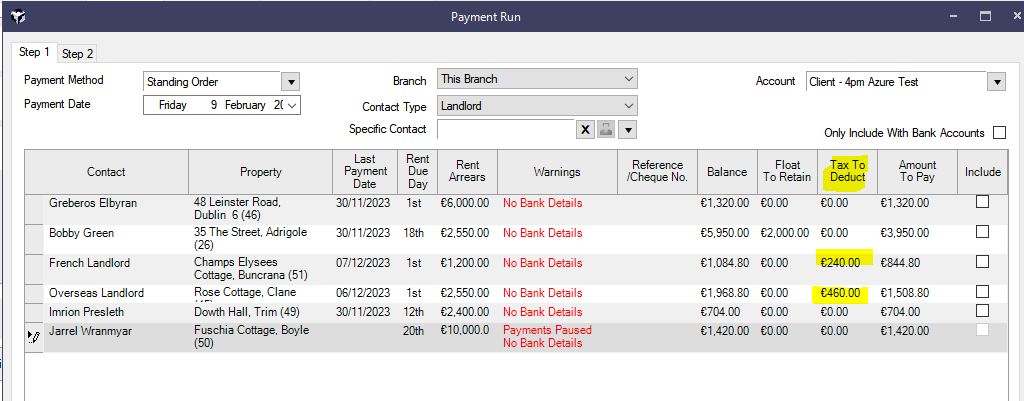

The amount to be withheld will be visible in the “Landlords to pay” screen, see below.

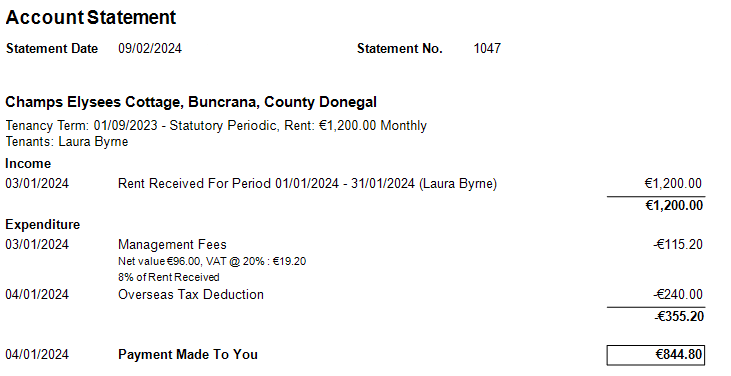

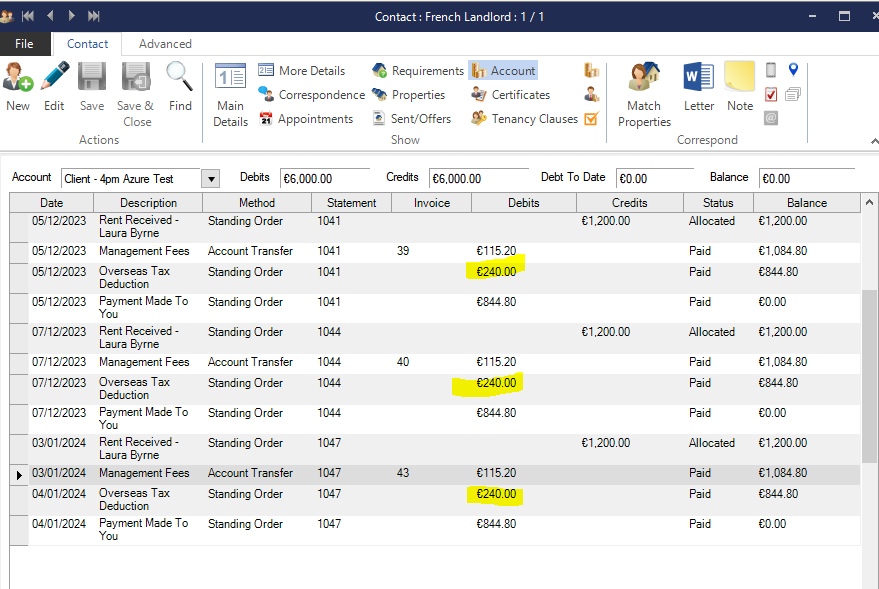

Once you run the statements to pay the landlords, it will appear in their statement, and in their account.

Records for overseas tax

Once the tax has been deducted from the landlord, it is kept separately so that it can be sent to Revenue.

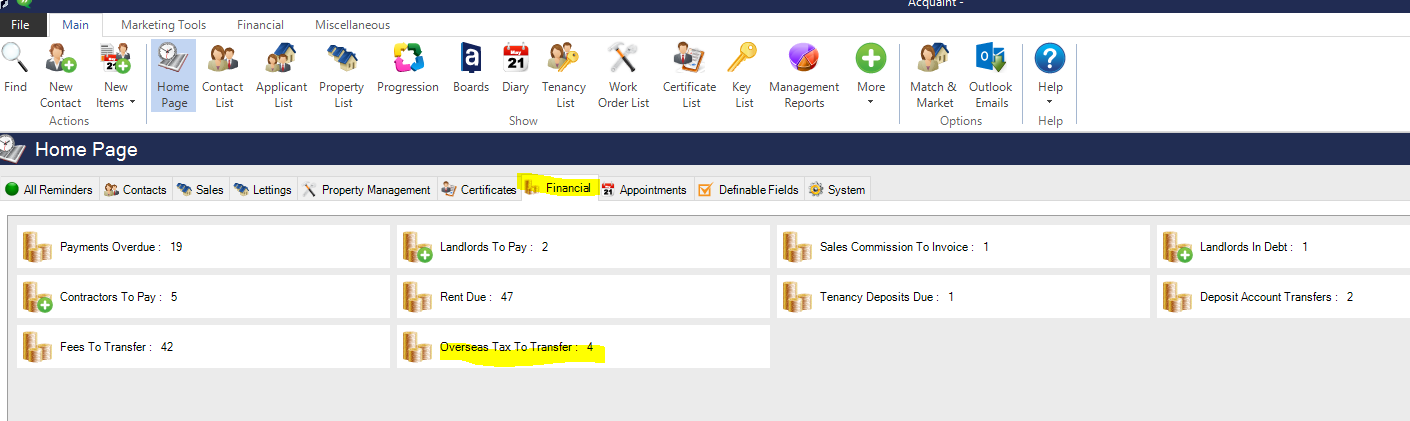

On the main Financial Page, there will be a section for “Overseas tax to transfer”. This is to be used when you are transferring the tax from your client account to Revenue.

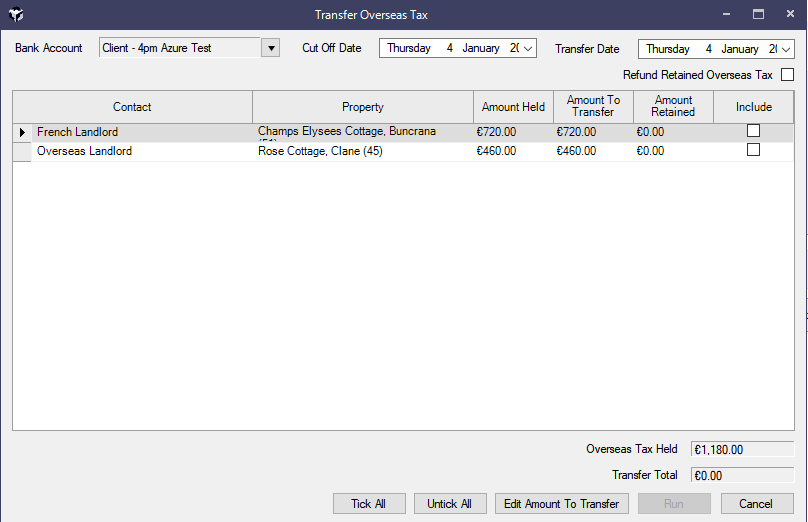

TRANSFERRING TAX WITHHELD OUT OF YOUR CLIENT ACCOUNT

When you select “Run” above, this will record a payment of overseas tax out of the client account. An export file will be created in your Acquaint Export folder, giving a breakdown of this payment, similar to the “Fees To Transfer” export file.

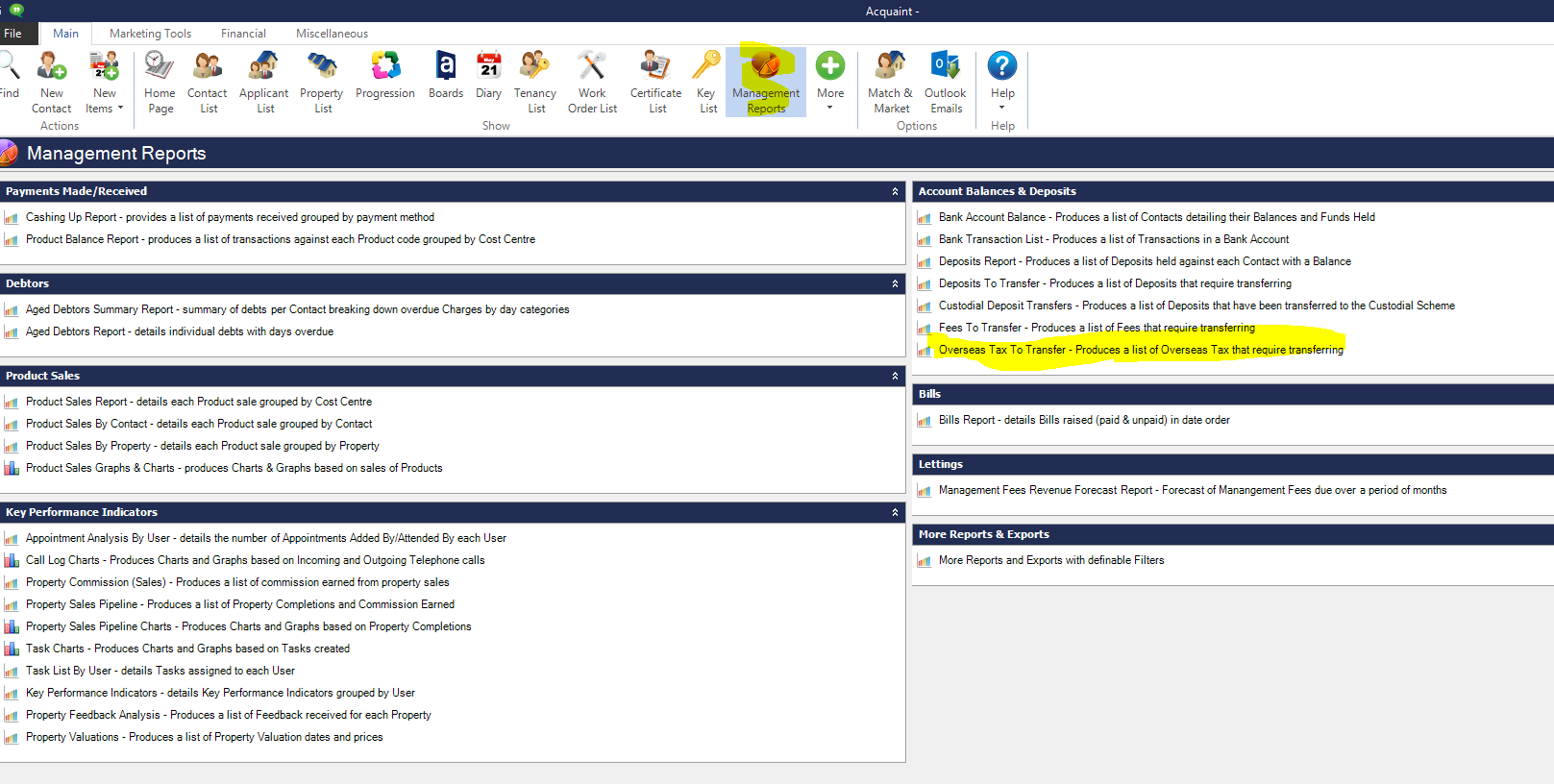

VIEWING BREAKDOWN FOR OVERSEAS TAX WITHHELD

If you simply want to see the breakdown of these figures, go into “Management Reports “ and select “Overseas tax to transfer”. This gives the breakdown of when the tax was withheld from the landlord. It will only give a breakdown of amounts that are still held in the client account, i.e. not yet transferred to Revenue.

NLWT Revenue Return

Information from Revenue on how to submit the monthly NLWT Rental Notifications can be found here:

https://www.revenue.ie/en/property/rental-income/nrlwt/index.aspx

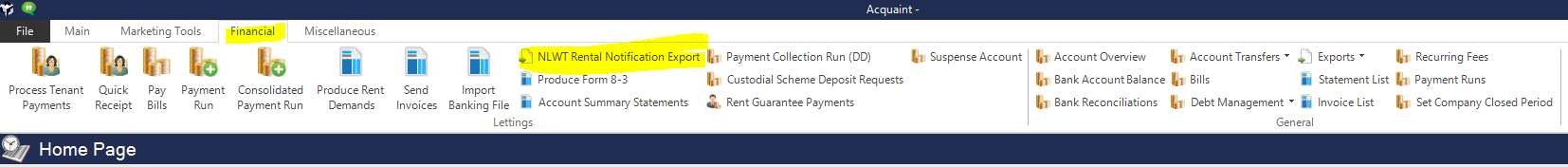

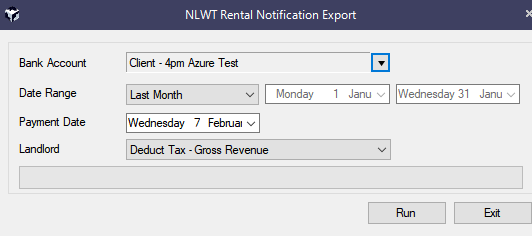

The NLWT form required to be submitted to Revenue can be found on the top Financial tab entitled “NLWT Rental Notification Export”.

The default date range is “last month” but you can change to any period that is required.

Ensure it is selecting “Deduct tax – gross revenue”.

This downloads as a CSV file, into your Acquaint Export folder, and can be amended as necessary before submitting it in your ROS system..

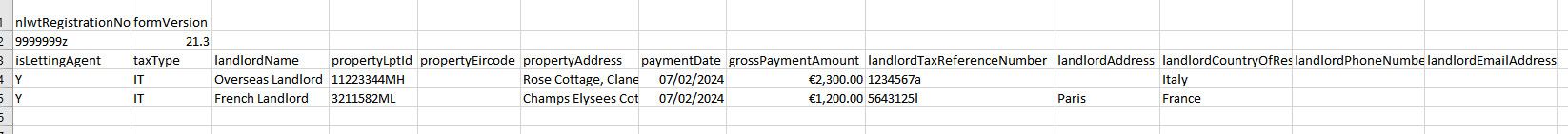

Copy of CSV file data:

Information to Note on above form:

NLWT registration number. This is your company’s PPS number. You can populate it in Acquaint by entering it as the PPS number for your “Company-system” contact.

Form Version 21.3 – this needs to be reflected as “21.3.0” before you submit the form to Revenue. This will be updated in the next Acquaint update.

The rest of the information is pulled from the Acquaint records of the respective landlords.

Matching the payments between Revenue and Acquaint

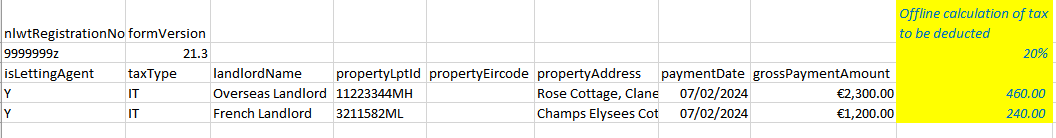

As you can see, the form being submitted to Revenue just shows the total rent received, not the amount that Revenue will take from your bank account.

They will take 20% of the amounts recorded in the “Gross Payment Amount” column. So it is important to check that this is correct and matches your records and the amount of tax withheld, before you submit the form to Revenue.

When I check my the figures I can now see how much tax will be taken (don’t add this calculation on the form you’re submitting to Revenue or it will be rejected) –

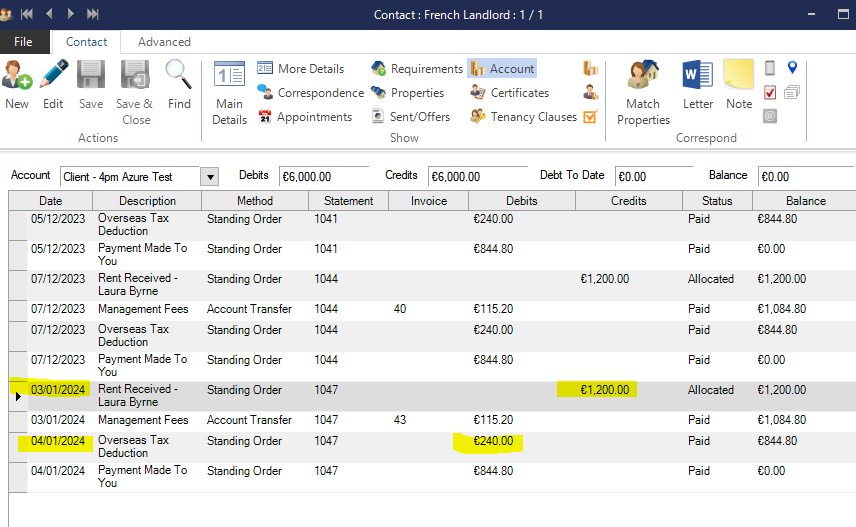

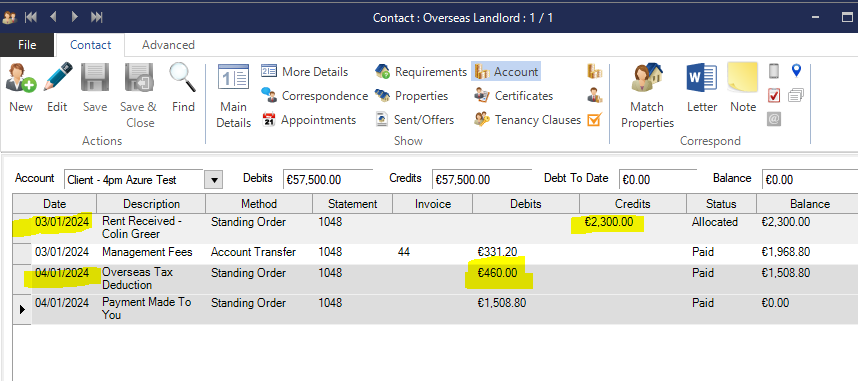

This was run for January 2024 and matches my records, see below –

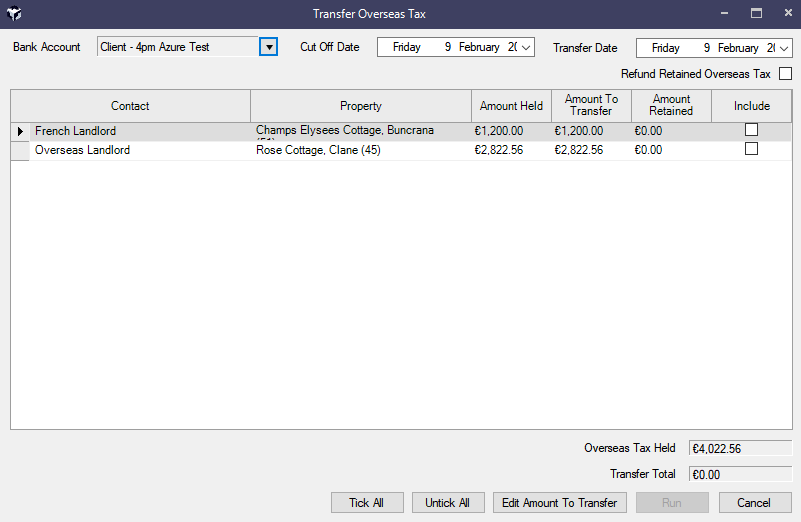

Next step is to record the payment of this tax from your client account. Go into the “Overseas tax to transfer” on the Financial section of the Home Page, as below.

In the case above, we are still holding tax from 2023, and we have only started the NLWT process from 2024, so we need to leave the 2023 withheld tax until the landlord or their accountant tells us to transfer the balance.

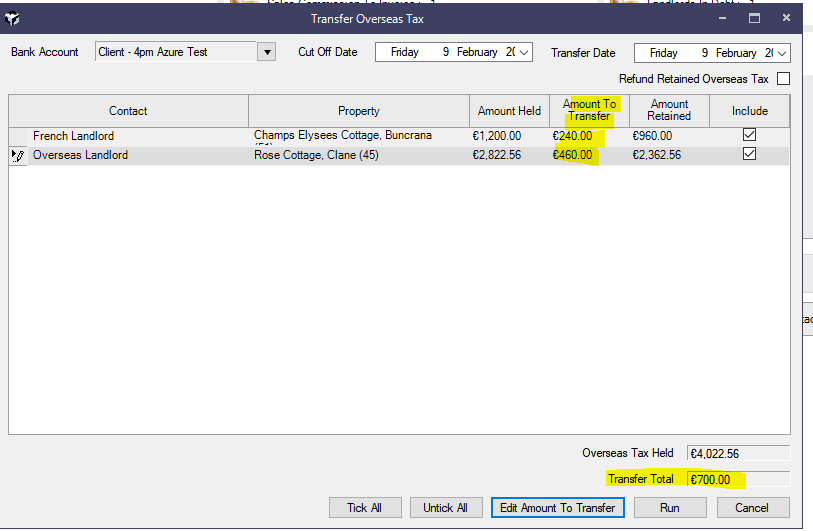

So therefore we need to choose “Edit amount to transfer” in order to match what Revenue have taken from our bank account, as follows:

Once this is run, a payment of €700 will be recorded on Acquaint, which should match the payment from the bank account to Revenue, and an Export File will automatically save in the Acquaint Export folder, which gives the details of what was included in the “overseas tax to transfer” transaction.

APPENDIX A

OVERSEAS TAX METHOD (Landlord, More Details tab)

There are four options here:

Do not deduct tax | This is the default for all Irish-resident landlords |

Do not deduct tax – handled by 3rd party | Choose this to have a non-Irish landlord’s address but where you are not collecting tax as you are not the collection agent. |

Deduct tax – Balance Minus Expenses | This will deduct 20% of the net amount (rent less expenses). Not really used any longer as doesn’t comply with Revenue’s new guidelines |

Deduct tax – Gross Revenue | Deducts 20% tax of the rent received regardless of the expenses. This is now required by Revenue for the monthly NLWT returns. |